My dad is an amazing woodworker. You might never know it, since he has spent most of his life managing a grocery store, but if you live in the small community known as Eastman, Georgia, then you probably have at least heard of Mike Law and his pens. He was always a woodworker before the pens. In fact, one of my earliest memories is helping him build a two-story shop in the backyard from the ground up, complete with 3-phase power, a full vacuum system for each of his large tools, storage for all our hand-me-down clothes, and a workout area. I remember the beginnings of his hobby (at least they were beginnings to me) starting with movable barbeque tables that he built for different members of the family. That eventually evolved into what I would call a musician’s love for the lathe. He loved that first lathe, and he had what I would describe as a musician’s joy for learning with it. Eventually that would turn into bowls, then drumsticks, then eventually custom pens made from wood, acrylic, or even deer antler.

I often asked my dad why he didn’t try to make more pens and maybe even try to make a small business out of it. After all, I often ended up at craft markets and saw pens that couldn’t even compare to his work heralding from three to ten times the prices that he was asking! In my eyes, he could make a killing, if only he would do it every day while he would normally be working. By my math, he could even work less. A lot less. What I didn’t understand at the time is that math isn’t that simple for a freelancer. Not even close.

For the last two years, I have been making a conscious effort to keep better track of the income that I make a freelancer, especially all the little “cash only” $50 gigs. Also, for the last few years, I have been learning hard lessons about income diversification and framing income differently. When my dad was making money selling pens, he always told me that it was his wood money, insinuating that it was to be spent on other woodworking needs only. It was almost like reinvesting in the small business that he didn’t have. At the time, I thought it was about keeping the money away from my mom and the house finances to keep things simple. I was partially right. My parents have been landlords for quite some time and part of that does mean that they must manage their money quite seriously and keep several different accounts balanced. In my dad’s case, he was trying to keep things simple, but also, he framed this as a hobby for himself and did not want to fall into the trap of continually spending family money on his hobby in the backyard.

This is how I framed my side-projects for most of my freelance life. When I was in my undergraduate studies, gig money was beer money. In fact, I played many shows for $20, a burger, and a pitcher of beer. To me, this was freelancing. I mean, it might as well have been. I was covering the bills playing and teaching music. My jobs teaching high school marching bands bought food and paid whatever utility bills or rent I owed, which back then was basically pennies on the dollar to today’s market and my gigging paid for the beer and the burgers. Life was perfect. Unfortunately, I failed to understand the difference between myself and my dad at that time. He had a full-time job that paid for the bills and his hobby money was just hobby money. He wasn’t a freelancer. He was a hobbyist. As a freelancer my side projects ARE my job.

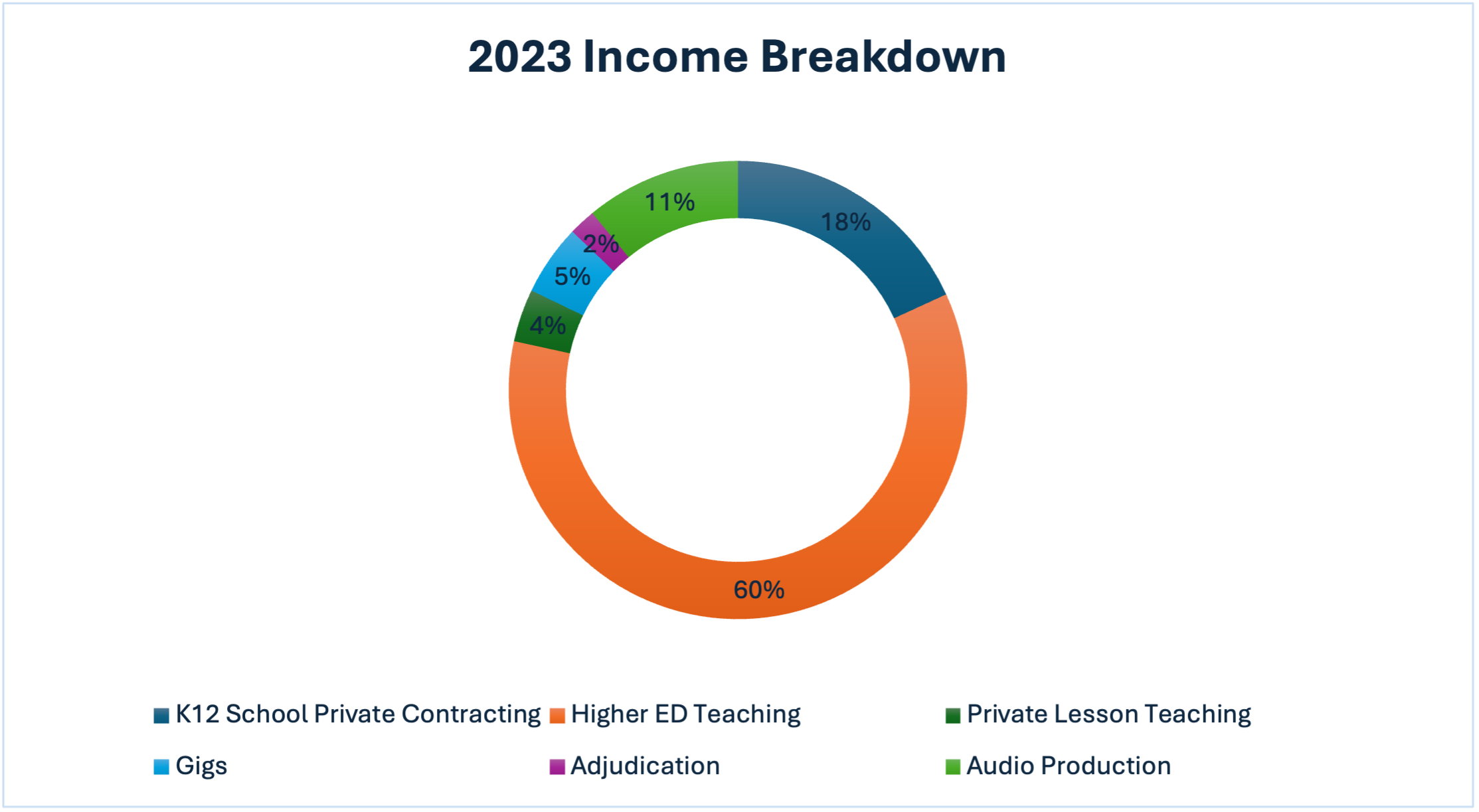

Once I realized that, I started to get a better understanding of how to do better financially. Of course, things were a lot easier before 2020. I had less bills, lived in a place with a much lower cost of living, and generally had less to worry about. Now the landscape has changed since 2020 and the bills only go up. The added pressure really helped me to look at what was actually coming into the bank account. Before I started tracking more, I was mostly just making sure enough was being deposited to make ends meet, but the breakdown really helps to understand more about “when, why, and how” instead of simply “how much”. Here is my 2023 in a pie chart.

Now parts of this may be deceiving at first, so let me explain the categories. K12 contracting includes all marching band, group lessons, masterclasses, and maintenance work done for K12 schools. This calendar year, I did most of that work with one high school with a few scattered individual appearances. Higher ED teaching is rather straightforward. This includes all teaching done at high education institutions including masterclasses and group lessons. This year I taught courses at two universities and gave masterclasses at two others. Private lessons includes all private lessons taught to any age for either percussion or music production. Gigs includes all paid performances. This year I worked with two bands regularly and did plenty of one-off performances with other artists or solo. Adjudication includes my work adjudicating for marching band circuits. Audio Production and Sound Design includes all work as an audio engineer, sound designer, or performances that also included sound design or consultation work.

So why even track it? Couldn’t I just be better with my money and frame it like real income instead of just hobby money? Sure, but also no. The big change actually comes in being able to understand my own limits and how they relate to the “dollars per hour” concept. When I assess this chart, I ask myself what areas have potential to bring in more income and how that may affect my productivity during that part of the year and my commitment to passion projects. For instance, I would love to make more money adjudicating this year, but each of those adjudication dates consumes a free Saturday between September and November. Notably, those are high value days for a marching band instructor. This is where subcategories, which I also track, come in. Could I adjudicate more in the winter season? Maybe, but that could affect my ability to work with my indoor percussion group or other indoor percussion groups. It is a delicate balance. What about gigs? Could I play more? Sure, but WHEN I play those gigs matters a lot. My involvement in drum corps consumes much of the summer. I already quite busy in the last months of year, as several of the groups that I play with do holiday events. The big money maker in the gigging season for me is about filling in more gigs in the first quarter of the year. It is analysis like this that is actually helpful.

The change in framing of this income is also helpful. It does it help me to separate simple spending money from business money, but, more importantly, it helps me to rationalize and prioritize my business expenses. As a freelancer, and especially as a percussionist and audio nerd, the expenses can add up. I have to make sure that I have the tools to perform my job and sometimes this means buying new speakers or updating my software. Sometimes it even means paying for a subscription to software like iZotope, which I use to quickly mix demo tracks or de-noise samples for clients. It may cost a monthly fee, but it cuts down on the hassle and headache to busy work and it can often mean that I can get projects out quicker and have more time more work, meaning more dollars in the account, meaning that I just paid for that subscription a few times over. It might not be that simple in the real day-to-day of the work, but understanding efficiency is key in this part of the analysis.

So what’s the takeaway? If you are a music freelancer, especially one with a multitude of revenue streams across several disciplines, you might find it helpful to start tracking your income a little more thoroughly and see if it helps you analyze where you could be more efficient or even just understand what job is the most “bang for the buck”.